The recent trade policy changes introduced by U.S. President Donald Trump, particularly the imposition of a 40% tariff on imports from Mauritius, represent a significant challenge for Mauritian exporters.

A tariff is a tax imposed by a government on goods imported or exported between countries. Import tariffs are more common and are used to regulate foreign trade, protect domestic industries, or generate government revenue. They increase the price of imported goods, encouraging consumers to choose locally produced alternatives. Export tariffs, though less frequent, are usually applied by developing countries to raise revenue or improve trade terms.

10% Baseline Tariff as Part of the Tariff Schedule

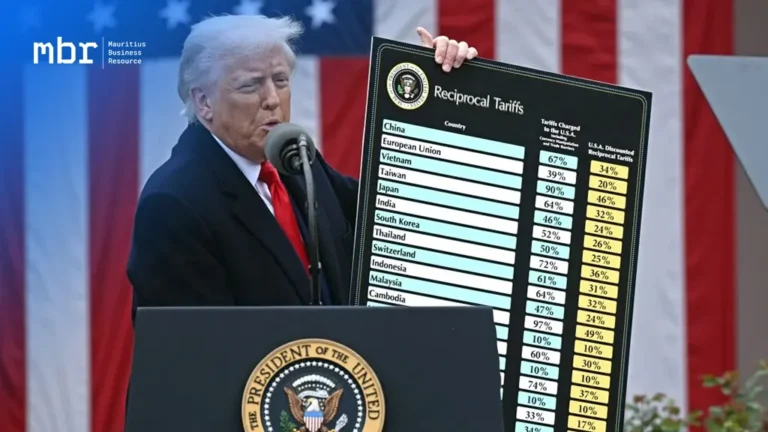

President Donald Trump declared a US economic emergency. In a background call before Trump’s speech, a senior White House official told reporters that the president would impose a “baseline” tariff on all imports to the US.

That rate is set at 10% and will go into effect on 5 April 2025.

The U.S. government argues that these new tariffs are necessary to restore fairness in international trade, pointing out that many affected countries impose high tariffs on American goods. The goal is to boost U.S. manufacturing, reduce the trade deficit, and ultimately lower the national debt by encouraging more domestic production and limiting reliance on foreign imports.

Mauritius is facing a big challenge due to new trade tariffs introduced by US President Donald Trump under his “Liberation Day” plan, which started on April 2. The White House announced that imports from Mauritius will now have 40% tax—much higher than the usual 10% rate for other countries.

| Country | Tariff |

|---|---|

| 🇱🇸 Lesotho | 50% |

| 🇰🇭 Cambodia | 49% |

| 🇱🇦 Laos | 48% |

| 🇲🇬 Madagascar | 47% |

| 🇻🇳 Vietnam | 46% |

| 🇲🇲 Myanmar | 45% |

| 🇱🇰 Sri Lanka | 44% |

| 🇫🇰 Falkland Islands | 42% |

| 🇸🇾 Syria | 41% |

| 🇲🇺 Mauritius | 40% |

| 🇮🇶 Iraq | 39% |

| 🇧🇼 Botswana | 38% |

| 🇬🇾 Guyana | 38% |

| 🇷🇸 Serbia | 38% |

The new tariffs imposed by the President Trump’s trade policy will have significant repercussions for Mauritius’ export industry.

Sectors that heavily exports to the U.S are:

1. Reduced Competitiveness in the U.S. Market

2. Threat to AGOA Benefits

3. Revenue Loss for Exporters

4. Economic Effects

5. Opportunity for Diversification

Mauritius is not alone in facing steep tariff hikes under Trump’s plan; other nations have also been hit with customized rates based on their perceived “unfair” trade practices:

| Country/Region | Tariff |

|---|---|

| 🇪🇺 European Union | 20% |

| 🇨🇳 China | 54% |

| 🇻🇳 Vietnam | 46% |

| 🇹🇭 Thailand | 36% |

| 🇯🇵 Japan | 24% |

| 🇰🇭 Cambodia | 49% |

| 🇿🇦 South Africa | 30% |

| 🇹🇼 Taiwan | 32% |

These new trade barriers will go into effect starting April 9, 2025.

The 40% tax introduced by the Trump administration is a big challenge for Mauritian exporters trying to stay in the U.S. market. While these changes are part of global trade trends, they hit smaller economies like Mauritius the hardest, as exports play a huge role in the country’s economy.

To overcome this obstacle, Mauritian businesses must explore new markets beyond the U.S., strengthen regional partnerships within Africa, and diversify their export portfolios by targeting emerging economies such as China and India. Additionally, government support through lobbying for favourable terms under AGOA or negotiating bilateral agreements will be crucial in mitigating these economic impacts.

Ultimately, innovation and adaptability will be key for Mauritian exporters as they navigate this evolving landscape of global trade policies.