Following a period of intense negotiations, the United States has finalized its reciprocal tariff on exports from Mauritius. As of August 7, 2025, the effective tariff rate is 15%, a significant reduction from the initially proposed 40% rate announced in April 2025. This development comes as part of President Trump’s “reciprocal tariff” policy that affects dozens of countries worldwide.. This new rate places Mauritius in a more favourable competitive position than many other global exporters.

The US administration’s tariff calculation is based on a straightforward formula using 2024 trade data. The initial rate was determined by dividing the US trade deficit with a country by its total US imports, and then halving the result.

Here is the breakdown using Mauritius’s 2024 trade figures:

*A trade deficit is when a country imports more goods and services than it exports.

This deficit-to-imports ratio of approximately 80% was then halved to arrive at the 40% initial rate, which was subsequently negotiated down to 15%.

Mauritius ranks #41 among US trading partners globally, representing just 0.0070% of total US imports worth $3.36 trillion in 2024. While this may seem modest, it positions Mauritius strategically within the African context and among smaller economies worldwide.

Among African countries trading with the US, Mauritius holds a middle position:

| African Country | US Rank | Import Value | Mauritius Comparison |

|---|---|---|---|

| Nigeria | #31 | $3.8 billion | 16x larger than Mauritius |

| South Africa | #33 | $2.1 billion | 9x larger than Mauritius |

| Egypt | #35 | $1.5 billion | 6x larger than Mauritius |

| Morocco | #36 | $1.2 billion | 5x larger than Mauritius |

| Mauritius | #41 | $234.5 million | Base comparison |

| Kenya | #38 | $600 million | 2.6x larger than Mauritius |

| Tunisia | #39 | $400 million | 1.7x larger than Mauritius |

| Ghana | #40 | $300 million | 1.3x larger than Mauritius |

The United States represents Mauritius’s 3rd largest export destination, accounting for 13.6% of total exports worth Rs 8.2 billion ($172 million). This positions the US as a crucial market, following South Africa (12% share) and Madagascar (10% share).

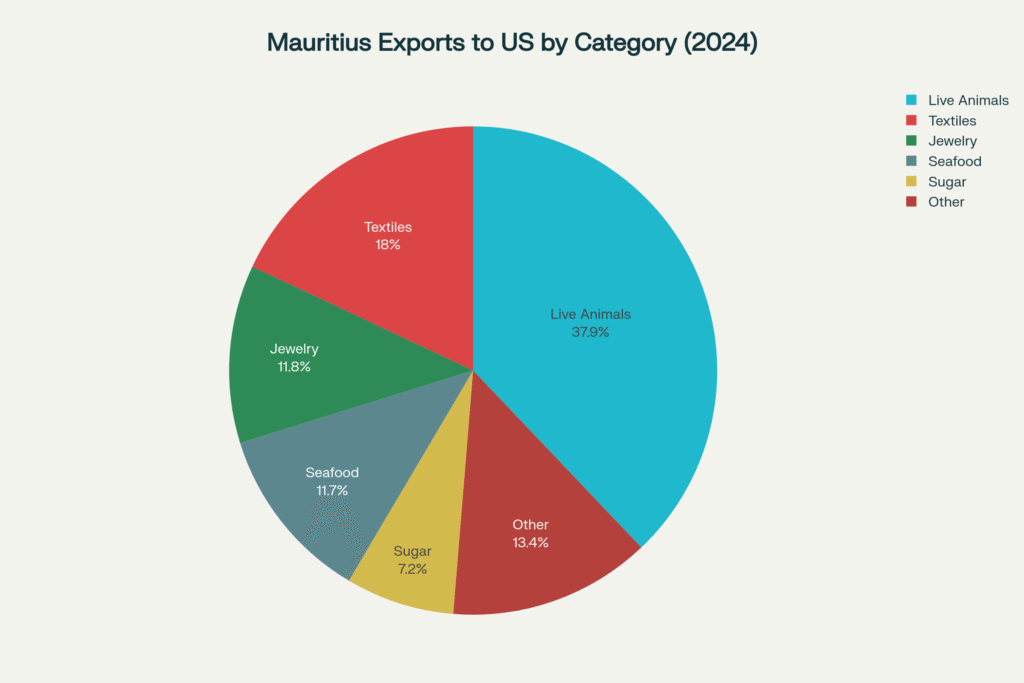

Mauritius’s export portfolio to the US is dominated by three key sectors, as illustrated in the breakdown below:

Live animals (primates) represent the largest export category at 37.9% of total exports, valued at $88.9 million in 2024. This sector includes long-tailed macaques used for biomedical research, where Mauritius supplies approximately 60% of US demand. The primate trade has become increasingly valuable, with individual animals selling for up to Rs 400,000 ($20,000) to US and European laboratories.

Textiles and apparel account for 18% of exports ($42.3 million), primarily benefiting from the African Growth and Opportunity Act (AGOA) preferences. Under AGOA, qualifying textile products can enter the US market duty-free, though the new tariff structure creates uncertainty about whether these preferences will override the reciprocal tariffs.

Fish and seafood products represent 11.7% of exports ($27.4 million), along with precious stones and jewelry at 11.8% ($27.7 million).

Understanding where Mauritian products go is crucial for entrepreneurs, whether you’re producing for the local market or eyeing export expansion. Here are the latest numbers for the top 5 export destinations of Mauritius in 2024, based on official trade statistics:

| Rank | Country | Export Value (Rs billion) | Share of Total Exports (%) |

|---|---|---|---|

| 1 | South Africa | 9.4 | 12 |

| 2 | Madagascar | 8.3 | 10 |

| 3 | United States | 8.2 | 10 |

| 4 | France | 7.5 | 9 |

| 5 | United Kingdom | 7.4 | 9 |

Key Takeaways:

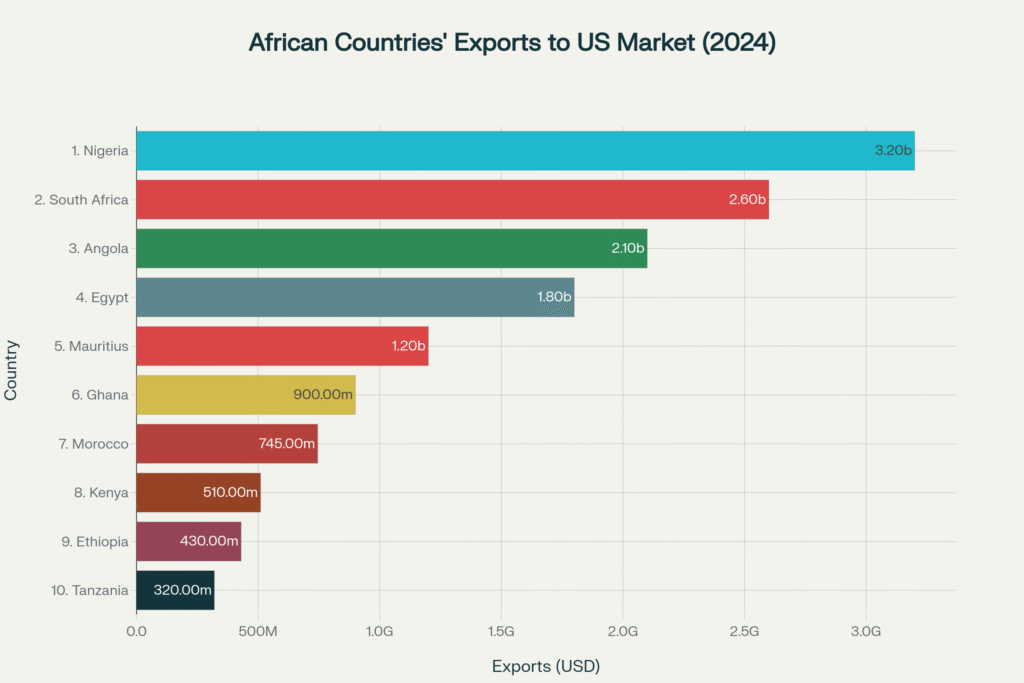

The chart below shows how Mauritius compares to other African countries in terms of exports to the US market in 2024. As illustrated, Mauritius ranks 5th among African nations with $234.5 million in exports, trailing Nigeria ($3.8B), South Africa ($2.1B), Egypt ($1.5B), and Morocco ($1.2B), but leading Kenya, Tunisia, and Ghana.

This data demonstrates that while Mauritius may seem small in absolute terms, it maintains a strategically important position both as a US trading partner and within the African context, particularly given its economic size and specialization in high-value sectors

The 15% tariff rate positions Mauritius favorably against several key competitors in the textile and manufacturing sectors:

| Country | Tariff Rate | Key Exports | AGOA Status |

|---|---|---|---|

| Mauritius | 15% | Primates, Textiles, Fish | Yes |

| Bangladesh | 35% | Apparel, Textiles | No |

| Vietnam | 20% | Apparel, Textiles | No |

| Madagascar | 47% | Textiles, Vanilla | Yes |

| Lesotho | 50% | Textiles, Diamonds | Yes |

| Cambodia | 19% | Apparel | No |

| Sri Lanka | 35% | Apparel | No |

| South Africa | 30% | Various goods | Yes |

This competitive advantage is particularly significant in the textile sector. While Bangladesh faces a punitive 35% tariff that could increase a $10 polo shirt’s final US price by 51%, Mauritius textile exporters operating under AGOA may maintain duty-free access or face only the 15% rate.

Madagascar, another key textile competitor in the region, faces a devastating 47% tariff that could result in 60,000 job losses in its textile sector. This creates opportunities for Mauritian manufacturers to capture displaced orders from buyers seeking lower-cost alternatives.

The 15% rate provides several competitive advantages. Mauritian textile manufacturers gain significant pricing advantages over Bangladesh (35% tariff), Sri Lanka (35%), and Madagascar (47%). The primate export sector, while facing increased costs, maintains its dominant market position due to limited global supply alternatives. Service sectors may benefit indirectly from competitors’ higher costs driving business toward Mauritius.

However, various challenges emerge from this tariff structure. AGOA benefits face uncertainty, as it remains unclear whether preferential access will override reciprocal tariffs. The primate sector, representing 38% of exports, faces increased costs that could affect US pharmaceutical research budgets. Export diversification becomes more critical to reduce dependence on the US market, which currently represents only 10% of total Mauritian exports.

Transport costs add another layer of complexity. Mauritian exporters already face higher logistics costs due to geographic isolation, and tariffs compound this disadvantage.

The current tariff environment creates several strategic opportunities for Mauritian businesses. Companies should consider capitalizing on competitor displacement, particularly in textiles where Madagascar and other high-tariff countries may lose market share. Strengthening AGOA utilization remains crucial – exporters should ensure full compliance with rules of origin to maintain duty-free access where possible.

Market diversification becomes essential, with the African Continental Free Trade Area (AfCFTA) offering opportunities to reduce US market dependence. The government’s ongoing negotiations with the US, including leveraging the Chagos agreement as a marker of geopolitical alignment, may yield further tariff reductions.

For local businesses, the 15% tariff translates to manageable additional costs compared to competitors. A textile product worth Rs 1,000 would incur an additional Rs 150 in US tariffs, while the same product from Bangladesh would face Rs 350 in additional costs. This Rs 200 advantage per Rs 1,000 of exports provides meaningful competitive positioning.