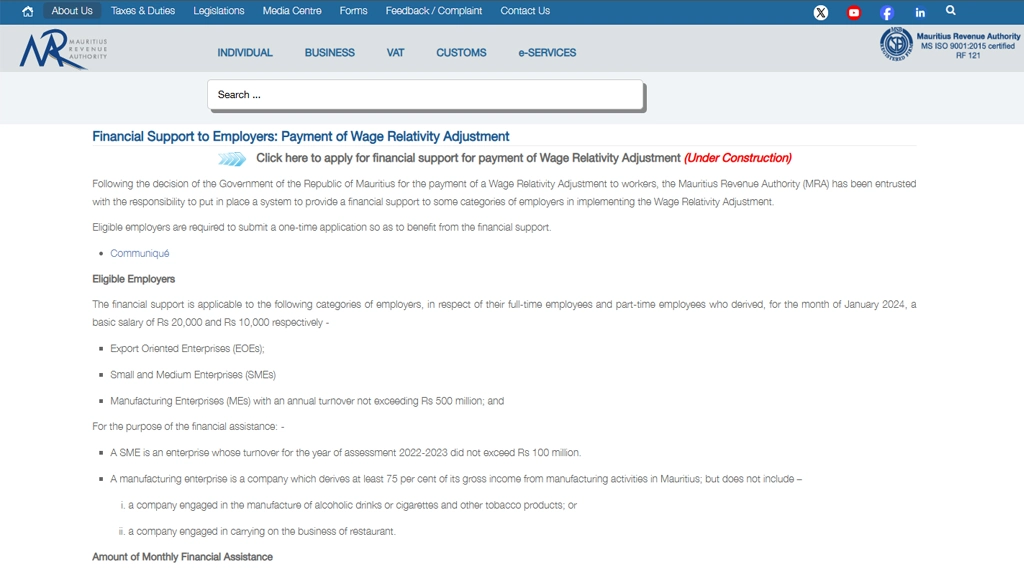

Attention Mauritius business owners! Feeling overwhelmed by the recent Wage Relativity Adjustment of August 2024? We’ve got some encouraging news for you. The government is stepping in with financial support to help eligible employers navigate this change. Let’s break down what this means for your business and how you could benefit from it.

The Wage Relativity Adjustment is a new initiative by the Government of Mauritius aimed at adjusting wages to better reflect the cost of living and maintain fair compensation across various sectors. This adjustment can be a significant change for many businesses, especially smaller ones, which is why the government is offering financial support to ease the transition.

First things first, let’s see if your business qualifies for this financial support. The scheme is open to:

To qualify, your employees should have earned a basic salary of up to Rs 20,000 for full-time or Rs 10,000 for part-time work in January 2024.

The government is providing financial assistance to certain businesses to help them cover the cost of increased wages.

Key Points:

The amount of assistance depends on the type of business and how much its profits are affected by the wage increase

The assistance is for employees earning up to Rs 20,000 (full-time) or Rs 10,000 (part-time) in January 2024

The assistance covers the “salary relativity adjustment,” which is the extra amount needed to meet the new minimum wage requirements

If you hire new employees after January 2024, you can still receive support, provided their basic salary (excluding the adjustment) doesn’t exceed Rs 20,000 for full-time or Rs 10,000 for part-time roles.

Ready to apply? Here’s how:

The Mauritius Revenue Authority (MRA) will verify your application and, upon approval, credit the funds to your bank account.

Once you submit your application, you’ll receive an acknowledgment message and a confirmation email. So, keep an eye on your inbox!

Please note that this financial support system is currently under construction. We’ll keep you updated once it’s available. In the meantime, you can click here to view the official announcement on the MRA website.

In conclusion, this financial support is a great opportunity to help your business adjust to the new wage requirements. Make sure you meet the eligibility criteria and follow the application steps carefully. Good luck, and here’s to your business thriving in 2024!